In both our personal and professional lives, we yearn for golden opportunities to present themselves. Small opportunities are nice enough, but it’s the really big ones that are the stuff of daydreams. The Bluebird Strategy is an approach to being open to those truly great opportunities, which I call “bluebirds,” while at the same time, reducing our risks and the effects that catastrophes may have on us. In this way, we keep catastrophes from distracting us from these great opportunities.

Positive and negative things happen to us every day. To be successful, we can’t shy away from the positive for fear of the negative. If our risk aversion is too high, we will miss a lot of opportunities. Nothing really bad is likely to happen, but nothing really good is, either. We always have to give up something in exchange for opportunity, whether it’s security, time, or money.

This is where I get the term “bluebird.” If we leave the window open for opportunities, there’s the chance that something wonderfully improbable will fly in. But being open also means being vulnerable – something awful can also fly in. That’s why mitigating our risks is so important. If we insure ourselves as best as we can against catastrophes, we’re more prepared to pursue outstanding prospects whenever they happen to flutter by.

These are the two parts of the Bluebird Strategy:

1) Actively opening ourselves up to bluebirds

PLUS

2) Controlling the possibility and/or impact of negative outcomes

“Keep on going and the chances are you will stumble on something, perhaps when you are least expecting it. I have never heard of anyone stumbling on something sitting down.” Charles F. Kettering

You may have heard of the book “The Black Swan” by Nassim Nicholas Taleb. In his book, he defines black swans as either positive or negative, improbable events with enormous impact. I define bluebirds as only highly improbable but highly positive events. Winning the lottery is an example. You know those commercials: “You’ve gotta be in it to win it.” Buying a Mega Millions ticket does come with a chance (about 1 in 175,711,536) of winning the jackpot, but it’s highly improbable. However, so were the odds of a startup company like Google becoming what it is today. The thing is, even if something is improbable, it’s still predictable: we just don’t know when and where it will hit. At some point, someone is going to win big in the lottery, and another unlikely little enterprise will change the way the world does things and net a fortune in the process. It’s fine to invest in some long shots – just don’t buy too many lottery tickets, whether they come in the form of Powerball tickets, startups, or anything else that holds the possibility of a dream.

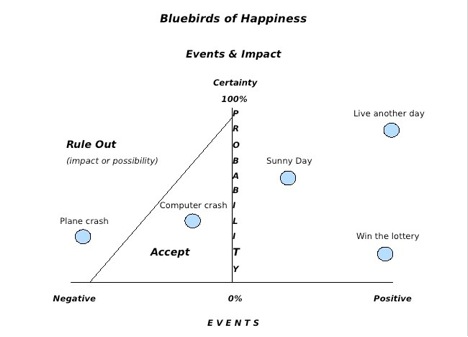

I’ve placed some events on the chart below based on a scale of impact (the X axis) and probability (the Y Axis). The events on the right side of the chart are positive outcomes and the ones on the left are negative outcomes, or catastrophes.

- High probability, highly positive: Living another day

- Low probability, highly positive: Winning the lottery

- High probability, highly negative: Experiencing health problems

- Low probability, highly negative: Perishing in a plane crash

Every day when we wake up, there are some positive things that are going to happen. For one thing, we’ve got a pretty good chance of living another day, and it may even be a sunny one. Unfortunately, it’s also reasonable to expect that we might experience a computer crash, or that there will be some kind of family crisis. There’s no getting around it: some negative and some positive things are going to occur that are entirely out of our control.

One way to seal ourselves off from risk is to never go out of the house and keep our windows closed. We’ll probably be safe there. But no bluebirds will ever come into our lives. We’ll never meet anybody special, never get that dream job… Nothing at all will happen, because we’ll be stuck inside, safe. Luckily, though, most of us willingly trade some security for the opportunity to live fulfilling, successful lives.

The diagonal “risk frontier” on the chart delineates tolerance to catastrophes and potential problems. Everyone’s risk tradeoff line is going to be different, and so is each company’s. A highly negative event, such as a plane crash, is something we all want to avoid. Yet, some of us will rule out the possibility entirely by refusing to ever fly, and others, like pilots, will mitigate the impact it would have on his family by making insurance arrangements in the unlikely event it happened. For all the events to the left of our risk frontier, we either want to arrange our lives so they won’t occur, or else invest the time and money necessary to lessen their blows.

To the right of the risk frontier are events where we will choose to simply accept the risks. Whenever you invest in reducing or eliminating a negative, you also give up a positive, such as time and/or money. That’s the nature of any insurance arrangement, and as an individual or a company, we want to invest our resources toward the highly probable, highly negative outcomes instead of the low-‐probability, low-‐impact ones.

For instance, we know that eventually our personal computer will crash. We just don’t know when. It doesn’t make sense for most of us to invest in redundant super-‐reliable hardware fit for running a spacecraft because the cost is so high. So instead, we accept the risk that our hardware will fail. Our resources are better spent enjoying life or preparing for highly negative or highly probably catastrophes. (Note: It does make sense, however, for most people to back up their data, and to avoid the negative impact that data loss would have on their lives.)

We insure ourselves against risks and catastrophes, we are more able to accept them when they do occur. The yin-‐yang effect that this has is that as we move that risk frontier to the left, increasing the amount of risk that we accept, it also preserves our resources and our ability to prepare for bluebirds.

Let’s take the example of cars to tie all the elements of the Bluebird Strategy together. You’ve got a really cool customized vintage car, and it’s running fine. You not only love driving it, but you also enter it into car shows, where it often wins the People’s Choice awards and earns you some cash and trophies to show off. You know that if you ever decide to sell it, and many

people have offered to take it off your hands, you’d make a nice return on your investment. Plus, it’s been pretty helpful in meeting pretty women at stoplights. In other words, that shiny automobile opens the window to a lot of prime opportunities. But you know a few things could start to go wrong… or that some character yakking on a cell phone could veer into your lane and mess up your nice paint job. You could, of course, never drive it and ensure that nothing happens to your four-‐wheeled beauty, but then you’d get nothing out of it. So instead, you give up a positive, money, and invest on an extended warranty and good insurance to mitigate anything negative that might happen, and just enjoy the ride. Taking those actions immediately heightens your ability to accept the inherent risks. The warranty and insurance don’t stop anything at all from happening, but they negate some of the impact on your life (and your wallet), and even add an element of positive by compensating you if something does.

Let’s apply the Bluebird Strategy to our working life. Looking back at the risk tradeoff line, we definitely want to rule out anything ruinous, such as going out of business, losing our jobs, being seen as incompetent, or having our skill sets become redundant or obsolete. Wherever possible, we’ll do anything we can to make sure that those things don’t happen to us. We can’t get an insurance policy against these things, but we can make insurance arrangements such as protecting ourselves by investing in quality personnel, continually learning, and putting our best foot forward in terms of usefulness and appearance to customers. If we take care of those things, we’ll be able to accept the remaining risks enough to allow us to be very open to bluebirds that come to us in our professional lives. At the same time, we’ll spend comparatively little energy on less negative or unlikely risks, such as constantly changing our passwords, and just accept that the slim possibility that the guy in the next cubicle might unexpectedly develop a mean streak, peer over our shoulders and get our password, then maliciously delete all our hard-‐won data. We don’t want to give up so much productivity ensuring ourselves to the hilt against everything under the sun when we could instead get out there and put ourselves where there may be bluebirds.

Another example is if we try to go into a new market where there is an opportunity for us to make money. The negative that comes along with that is the possibility for insolvency if we spend too much and don’t earn any revenue. We handle that by investing time in preparation, research, and budgeting. But we don’t want to invest unnecessarily in countless tests and reports because we’re scared that we’re going to miss some little thing, or spend hours worrying about every nickel when it’s the hundred-‐dollar bills we’re after. We understand that we’ll learn some things along the way as we grow, and just accept that we may have to deal with some problems as they occur. That leaves us free to welcome all the things on the right side of the Y Axis in our new venture, and of course we’re open to as many as those as we can get.

Some companies are so risk averse that their risk frontier is very steep, allowing little possibility for anything at all to go wrong. They really like to be in control of the minutiae. Since they’re going to put up with a heck of a lot less risk, fewer negative things are going to happen to them. But they’ll also have fewer opportunities.

Then there are the risk takers. They take that risk frontier and run its lower bound far out to the left. True, that allows a lot more wiggle room for those surprising little negatives and obstacles, but it also means there’s a whole lot more possibility for truly exciting events to take place. They accept that there may be unforeseen problems and are willing to take on those risks. They’re not insuring themselves or investing in limiting the downside risks so much that they prevent fresh ideas from taking wing.

A company that’s a startup may have a risk frontier where they don’t rule out anything. If they go bankrupt, they go bankrupt. They’re going to spend the money and take their shot, and they’re going to make it or they’re going to fail. When you first start up, you don’t worry about failing. You worry about eating. So you just go out there and get whatever clients you can. Then, if your business starts earning millions, that line may begin to creep in from the left because you’ve got a great deal more to lose. The negative impact of insolvency is much greater when you have something than when you have nothing.

Just like with many people as they get older, as companies get bigger, they’re less eager to take risks. I’ve heard of an 85-‐year-‐old woman who rides cross-‐country on a Harley-‐Davidson, but a lot of people her age have decided that things like riding motorcycles or jumping out of airplanes aren’t worth the risk anymore. Similarly, a new company may be willing to go out on a tall limb with amazing new product ideas, while a large company might stick to the tried and true. Big companies are often so invested in ruling out risks to the size of their company and to their business that their opportunity curve is very narrow. That’s why blue chip companies are good investments, because they’ve eliminated the risks. But they’ve also eliminated the opportunities, so there’s no chance you’re going to make tons of money off of them, either.

A company like Google, on the other hand, started off with nothing. They took huge risks, and venture capitalists got involved. Those investors expected 90+% of the time to lose their money, but they also had a big opportunity, and when that kind of opportunity hits, it hits big.

The key to a successful company is to take on as much risk as you reasonably can without raising too much the likelihood of financial catastrophe. We want to keep the risk tradeoff line in a place where we are comfortable with the risks we accept, and where the risks we accept won’t overwhelm us. It’s a balancing act. We want to identify the possible bluebirds and the possible catastrophes, and then plan for them. We have to be thoughtful, but we also have to understand that every time we do something, we need to create a strategy to eliminate the negative. On the other hand, becoming fanatical imposes too high a cost and reduces the likelihood of something positive happening.

The Bluebird Strategy was developed from my observations that most businesses are successful not because they did something spectacular, but because they didn’t do anything foolish. If you can stay in business long enough and keep yourself from going out of business because of a catastrophe, the bluebirds will fall in the window every once in a while. That’s the most reliable strategy I know.

“Watch the downside; the upside will take care of itself.”

-‐ Marty Gruss, a remarkably successful investor

© 2012 Ralph Dandrea. All rights reserved.

Leave a Reply